The Field Service Management market research study delivers current market analysis plus a five year market and technology forecast. The study is available in multiple editions including worldwide, all regions, and most major countries.

New ARC Research Shows Growth in Field Service Management Systems

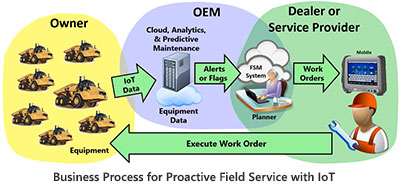

New ARC Advisory Group research on the Field Service Management (FSM) market reveals that several drivers are converging to drive growth. OEMs are using IoT technologies to offer new value-added aftermarket services for their customers. Equipment issues can now be identified prior to failure. Service providers are also using field service management to better manage their operations, from call center to service execution and billing. FSM controls costs and improves the customer’s overall service experience.

The field service management market is increasingly connected to, and dependent on, real-time information from the field to function efficiently and effectively. This need for interoperability with remote asset health monitoring systems is enabled by advancements in industrial networks, the Industrial Internet of Things (IIoT), multifunctional sensors, and edge devices.

Field Service Management Strategic Issues

In addition to providing a five-year market forecast, the Flowmeters Market Research Report provides detailed quantitative, current market data and addresses key strategic issues as follows:

In addition to providing a five-year market forecast, the Flowmeters Market Research Report provides detailed quantitative, current market data and addresses key strategic issues as follows:

Focus on the Business Case When Considering Field Service Management Solutions

It’s important to justify investments in FSM based on growing revenue and profit potential with new services, rather than just focusing on cost reduction strategies. With FSM, there is an opportunity (particularly with OEMs) to run the maintenance operation as a bona fide profit and loss (P&L) operation–one that provides tools to manage both costs and revenues. Capturing revenue opportunities and improving internal efficiencies are needed in today’s FSM operations, and far more impactful to organizations than marginally reducing costs and placing too much emphasis on soft (non-financial) costs.

Transitioning the services into a P&L center aligns with executive metrics, gets their attention, and obtains the resources needed to be successful. Service providers need a good service execution program, from the receipt of an alert to making a repair, to reporting to the client. In the past, service had often been a difficult business to manage with sporadic urgent calls for repairs that were beyond the capability of an on-site, general-purpose technician. With IoT and predictive maintenance capabilities, maintenance organizations can have advanced notice, insight into the problem, and time to optimize field service schedules.

Offer Services Melding Digital Transformation and Advanced Predictive Capabilities

一個健壯的基礎和可持續的檢修e business model includes comprehensive planning and strong execution. Preventing unscheduled downtime has huge value for the manufacturer, which dramatically improves the business case for purchasing a service agreement.

Leveraging IoT with elements of predictive maintenance, reliability centered maintenance (RCM), and root cause analysis (RCA), OEMs and their dealers and service providers have an opportunity to grow a profitable and significant revenue stream via service agreements. With proactive support, it often makes business sense for the end user to outsource maintenance to the service provider. Adopting IoT, enterprise connectivity, and analytics for condition monitoring and predictive maintenance services can help to boost customer satisfaction and deliver an outstanding customer experience.

Proactive repair rather than reactive maintenance prevents unplanned downtime, which usually has huge value for the end user. Unplanned downtime leads to losses in work-in-process materials, lost production, and reduced revenues. The associated impact on margin and sales affects the P&L statement and gets management attention. OEMs, their dealers, and other service organizations can mitigate these issues by leveraging the collective capabilities of FSM, digital transformation, and predictive maintenance and predictive analytics

Expand Mobility and Visualization Capabilities to Optimize Field Service Delivery

Completely review field service business processes when adopting an FSM application. Avoid replicating current manual and paper processes in digital form. A structured approach to this business process optimization includes value stream mapping, which is also a key lean manufacturing practice.

Common smartphones and tablets should be used to deploy FSM. Mobility encourages adoption, improves usability, and lowers overall service delivery costs. With mobility, processing a work order becomes part of the workflow of a technician. The corresponding data entry has far fewer errors, which improves overall system integrity. The FSM solution becomes a trusted system for scheduling and execution.

Mobility and visuals also improve the first-time fix rate (FTFR) by giving the technician access to resources like documentation and other more experienced technicians. The novice can access a standard operating procedure or manual while on the job site in real time. Even experienced technicians can be confronted with an issue where they need support. Mobility allows the technician to communicate with a subject matter expert, share photos/videos, and obtain specific feedback.

Field Service Management Study Formats and Editions Available

This market study may be purchased as an Excel Workbook and/or as a PDF File. The Workbook has some unique features such as the ability to view data in local currency. Regional studies include country and industry market data. Country studies include market trends and industry data. Studies and formats available are listed below:

| MIRA Workbook | PDF File | |

| Worldwide (includes regional data) | Yes | Yes |

| North America (includes country data) | Yes | No |

| Latin America (includes country data) | Yes | No |

| Europe, Middle East, Africa (includes country data) | Yes | No |

| Asia (includes country data) | Yes | No |

| Annual Subscription | Yes | Yes |

Countries included in each region.

Table of contents for these studies is shown in the following paragraphs.

Worldwide Research Focus Areas

Strategic Analysis

- Major Trends

- Industry Trends

- 地區的趨勢

- Strategies for Success

Scope

Competitive Analysis

- Market Shares of the Leading Suppliers

- Market Shares by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Market Shares by Revenue Category

- Software

- Services

- Market Shares by Service Type

- Software as a Service

- Maintenance & Support Services

- Implementation Services

- Market Shares by Industry

- Aerospace & Defense

- Buildings

- Electric Power Generation

- Electric Power T&D

- Financial

- Food & Beverage

- Government

- Healthcare

- Machinery Manufacturing

- Oil & Gas

- Pharmaceutical & Biotech

- Telecommunications

- Transportation & Logistics

- Water & Wastewater

- Market Shares by Customer Type

- OEM

- Service Provider

- Dealership

- Self Service

- Market Shares by Deployment Model

- Cloud

- Hosted

- On-Premise

- Market Shares by Customer Size

- Market Shares by Sales Channel

Market Forecasts and Histories

- Total Shipments of Field Service Management

- Shipments by Region

- North America

- Europe, Middle East, Africa

- Asia

- Latin America

- Shipments by Revenue Category

- Software

- Services

- Shipments by Service Type

- Maintenance & Support Services

- Implementation Services

- Software as a Service

- Shipments by Industry

- Aerospace & Defense

- Buildings

- Electric Power Generation

- Electric Power T&D

- Financial

- Food & Beverage

- Government

- Healthcare

- Machinery Manufacturing

- Oil & Gas

- Pharmaceutical & Biotech

- Telecommunications

- Transportation & Logistics

- Water & Wastewater

- Shipments by Customer Type

- OEM

- Service Provider

- Dealership

- Self Service

- Shipments by Deployment Model

- Cloud

- Hosted

- On-Premise

- Shipments by Customer Size

- 發貨的銷售渠道

Industry Participants

The research identifies all relevant suppliers serving this market.

Regional Research Focus Areas

Strategic Analysis

Competitive Analysis

- Leading Suppliers in Region

- Industry Shares in Region

- Country Shares in Region

- Leading Suppliers by Industry

Market History & Forecast Analysis

- Market History & Forecast by Country

- Market History & Forecast by Industry

Industry Participants

List of countries & currencies included in each region:MIRA-Country

For More Information

For more information or to purchase the Field Service Management Market Research study, pleasecontact us.